By Keith Gangl, CFA®

Posted on Aug 1, 2025

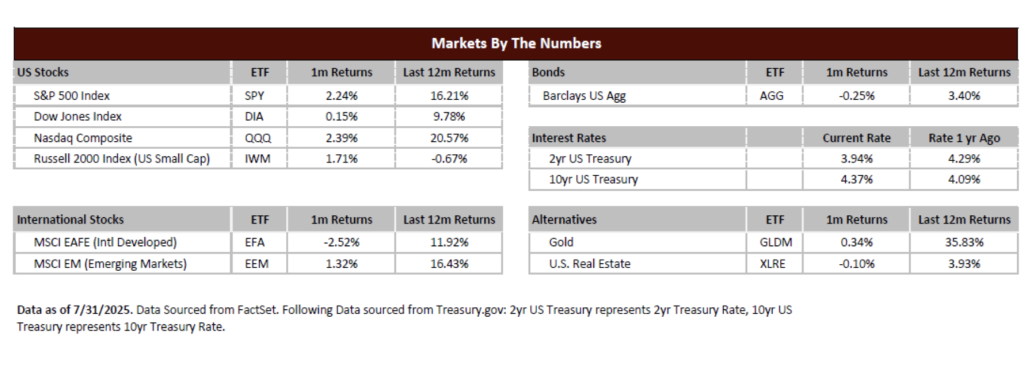

The stock market’s second half began where the first half ended with continued strength and continuing its winning ways. The S&P 500 gained 2.24% in July while establishing new all-time highs throughout the month. This sustained rally reflects three key catalysts driving market optimism: corporate earnings consistently surpassing expectations, increasingly favorable international trade agreements, and a notable uptick in investor confidence.

The second quarter earnings reports released in July demonstrated broad-based economic strength. As the month concluded, over half of S&P 500 companies had reported results, with an impressive 80% exceeding earnings per share expectations. This performance provides fundamental support for continued market appreciation.

Technology giants led this earnings resurgence, with Meta Platforms (META), Microsoft (MSFT), and Alphabet (GOOG) delivering standout quarterly results. The artificial intelligence revolution continues as a powerful secular growth driver, particularly benefiting these market-leading companies whose substantial index weightings amplify their positive impact on broader indexes.

While this earnings cycle demonstrates corporate America’s ability to generate sustainable growth, the true test will be whether remaining companies can match this performance standard throughout the second half of earnings season and the remainder of the year.

July brought significant developments in international trade relations that further energized market participants. Comprehensive tariff agreements with two of America’s most important trading partners — the European Union and Japan — represent a meaningful shift toward economic cooperation.

These deals extend beyond tariff reductions (from those announced on “liberation day”) to include substantial capital commitments. The EU pledged $600 billion in direct US investment, while Japan committed $550 billion to American economic development. Additionally, the European Union committed $750 billion specifically toward US energy sector investments. These agreements not only reduce trade friction but also inject significant foreign capital into the domestic economy, creating a multiplier effect that should benefit multiple sectors.

Market psychology has benefited from the self-reinforcing cycle of rising asset prices and improving investor confidence. This positive feedback loop, while creating upward momentum during bull markets, had worked in reverse during April’s market correction, demonstrating the powerful influence of sentiment on market dynamics. Recent economic data has provided validation for this renewed optimism, most notably the preliminary Q2 GDP reading of 3.0%, a full percentage point above the 2.0% consensus expectation. This economic acceleration is particularly impressive given the first quarter’s 0.5% contraction, representing a 3.5 percentage point improvement that has bolstered investor confidence in the economy’s underlying resilience and growth trajectory.

The convergence of strong corporate earnings, favorable trade developments, and improving economic fundamentals has created a supportive environment for equity markets. The strong start to second quarter earnings season and substantial international investment commitments provide near-term optimism.

However, investors should remain vigilant about the sustainability of this momentum. While the turnaround from a contracting economy in Q1 to 3% growth in Q2 demonstrates market resilience, continued monitoring of earnings quality, trade policy implementation, and economic indicators will be crucial for maintaining this positive trajectory. As market participants look ahead, the foundation appears solid, though prudent risk management remains essential in navigating potential volatility.